The deviation report explained

In this article

What is the deviation report?

The deviation report is a worksheet within the downloadable material, labour bills and fixed costs bills.

The purpose of the 'Deviation' tab is to provide a powerful and easy way to understand reasons behind any differential between your current projected spend (accounting for any fluctuations) and your:

- Tender projections i.e. your budgeted costs when your project was accepted onsite, based on tendered rate build ups and tendered measures.

- Live projections i.e. your projected costs at completion, based on current rate build ups and current measures.

Worked example

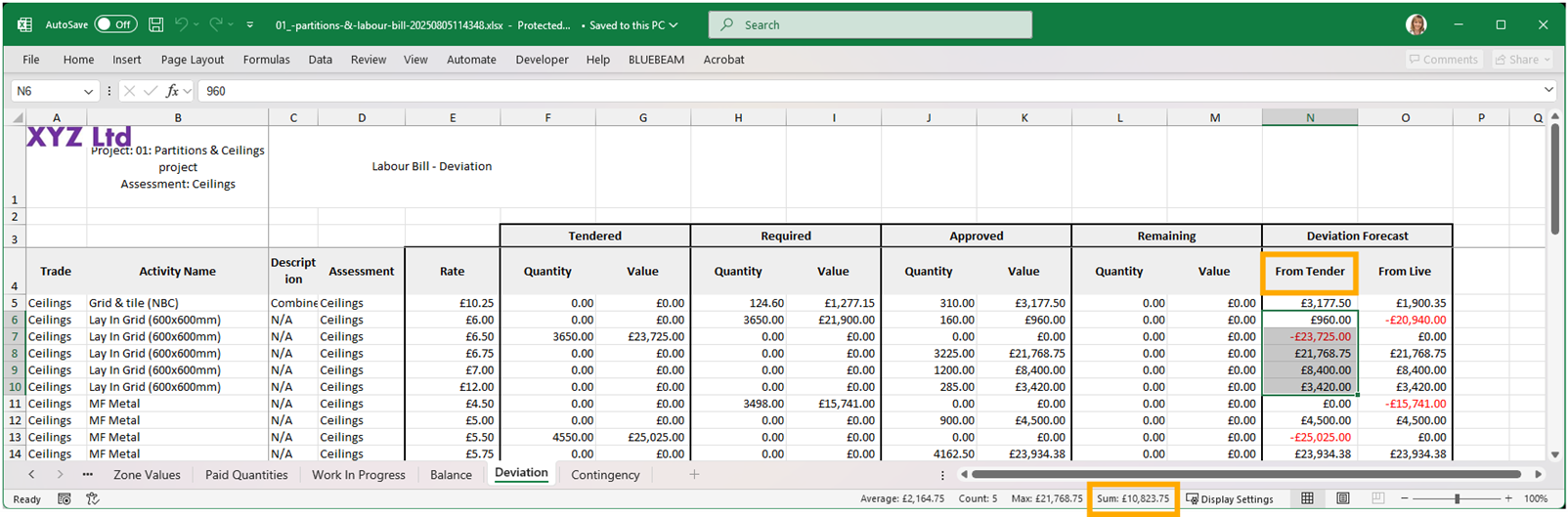

Below is an example deviation report from the labour bill on a project.

Whenever we have used a different rate for a labour activity either in our tender, our onsite assessment or on labour applications you will see that labour activity duplicated for example rows 6-10 in the screenshot above.

Lay in Grid (600x600mm) has had different rates set from £6.00 up to £12.00 (which can be seen in column E.

Tendered

We can see from row 7 in this example we tendered the Lay In Grid activity at £6.50 with a quantity of 3650

Required (onsite assessment)

Post tender we adjusted the cost down to £6.00 with the same quantity of 3650 – this is our current budget for that activity.

Approved (labour applications)

In this example we’ve approved labour applications with that activity of Lay In Grid with a range of different rates.

- 160 @ £6.00

- 3225 @ £6.75

- 1200 @ £7.00

- 285 @ £12.00

Remaining

The total quantity we have approved for Lay in Grid is

160 + 3225 + 1200 + 285 = 4870

This exceeds the current required quantity of 3650 so the system states there is no quantity budget remaining.

If we hadn’t used up all the quantity, any remaining allocation would be shown in this column on the same row as the ‘Required’ quantity.

Deviation Forecast

In this column, if you sum the values in either the From Tender or From Live column for a given labour activity:

A negative value means it is within your budget

A positive value means you have exceeded your budget

From Tender

Example 1

The deviation forecast column is split into two sections.

The From Tender values show how what you have currently spent varies from your original tendered budget.

The easiest way to use this column is to sum the values for all rows relating to particular labour activity (as shown above).

We originally budgeted, at tender, £23,725.00 for Lay in Grid as shown in cell G7.

Because we haven’t paid any labour at the £6.50 rate, this shows as a negative value in the from tender column because we haven’t used that budget.

The other figures are taken from the ‘Approved Value’ column at the various related rates.

When we sum these values we get a value of £10,823.75 (as shown above)

This comes from:

Sum of approved values – original tendered budget

£34,548.75 – £23,725.00 = £10,823.75

This indicates that we have overspent on labour for this activity vs our tendered budget by £10,823.75

Example 2

In this example for Shadow Batten & Perimeter Trim

We budgeted at tender for 1800 at £4.50

In our onsite assessment we adjusted that to 1745.59 at £2.00

We haven’t approved labour claims for any of that activity

We have 1745.59 still left in our budget

Based on our original tendered budget if we sum those figures together we get -£4,608.82.

This means we have made a potential saving by reducing the rate and quantity of £4,608.82 for this activity.

From Live

With our Lay in Grid activity we can see that in our current onsite assessment we have budgeted for 3650 at £6.00

We have paid out 160 at that rate but we have also paid out additional quantities at higher rates.

When we sum the values in the From Live column for that activity, we get a total of £12,648.75. This indicates an overspend for that labour activity.

This is made up of

At £6.00 rate we budgeted £21,900, we approved £960 so we have £20,940 unused (so it appears as a negative figure)

At £6.75 rate we had no budget at this rate, we approved £21,768.75

At £7.00 rate we had no budget at this rate, we approved £8,400.00

At £12.00 rate we had no budget at this rate, we approved £3,420.00